No-Fault Laws and Impacts

New York State No‑Fault Laws: Structure & Impacts

1. Mandatory No‑Fault (PIP) Coverage

Every New York driver must carry Personal Injury Protection (PIP), or no‑fault insurance, which covers economic losses regardless of fault

Coverage Includes:

- Up to $50,000 per person in basic economic loss, covering medical and rehabilitation expenses

- 80% of lost wages, capped at $2,000/month for up to 3 years

- Up to $25/day for up to 1 year for reasonable and necessary expenses like household help or transportation

- A $2,000 death benefit payable to the insured’s estate if death results from the accident, in addition to the $50,000 limit

- Up to $50,000 per person in basic economic loss, covering medical and rehabilitation expenses

- 80% of lost wages, capped at $2,000/month for up to 3 years

- Up to $25/day for up to 1 year for reasonable and necessary expenses like household help or transportation

- A $2,000 death benefit payable to the insured’s estate if death results from the accident, in addition to the $50,000 limit

Impact:

- Faster payouts: medical bills and economic losses processed quickly by your own insurer

- Limits litigation: reduces pressure on courts and streamlines recovery, especially for minor injuries

- Faster payouts: medical bills and economic losses processed quickly by your own insurer

- Limits litigation: reduces pressure on courts and streamlines recovery, especially for minor injuries

2. Eligibility & Exclusions

- Who is covered: Named insured, household residents, vehicle passengers, pedestrians and cyclists injured by the insured vehicle in New York State

- Excluded: individuals who were drunk or impaired, riding motorcycles, intentionally self‑injured, involved in felonies (e.g. stolen vehicle), or not carrying a valid NY insurance policy

- Who is covered: Named insured, household residents, vehicle passengers, pedestrians and cyclists injured by the insured vehicle in New York State

- Excluded: individuals who were drunk or impaired, riding motorcycles, intentionally self‑injured, involved in felonies (e.g. stolen vehicle), or not carrying a valid NY insurance policy

Impact:

- Protects a broad range of victims, but disqualifies individuals engaged in wrongdoing during the accident, potentially denying them basic benefits.

3. Going Outside the No‑Fault System: Serious Injury Threshold

You can only sue the at‑fault party for non‑economic damages like pain and suffering if:

- Your basic economic losses exceed $50,000, or

- You suffer a legally defined “serious injury”, including:

- death, fractures, disfigurement, permanent organ or body part loss, significant loss or limitation of bodily function, or inability to perform customary daily activities for 90 out of the 180 days post‑accident

- Your basic economic losses exceed $50,000, or

- You suffer a legally defined “serious injury”, including:

- death, fractures, disfigurement, permanent organ or body part loss, significant loss or limitation of bodily function, or inability to perform customary daily activities for 90 out of the 180 days post‑accident

Impact:

- The threshold restricts lawsuits to serious cases, limiting exposure for insurers but also potentially denying fair compensation for moderate injury

- Requires strong medical documentation and legal support

- The threshold restricts lawsuits to serious cases, limiting exposure for insurers but also potentially denying fair compensation for moderate injury

- Requires strong medical documentation and legal support

4. Statutory Offsets & Compliance Rules

- PIP lost wage payments are subject to a 20% offset and must deduct other disability benefits such as workers’ comp or SSDI—ordering of offsets depends on taxability of those benefits

- Medical bills must be submitted within 45 days, lost wages within 90 days, and initial no‑fault claim filed within 30 days after accident

- Accident must be reported within 10 days to DMV if injury, death, or significant property damage occurred

- PIP lost wage payments are subject to a 20% offset and must deduct other disability benefits such as workers’ comp or SSDI—ordering of offsets depends on taxability of those benefits

- Medical bills must be submitted within 45 days, lost wages within 90 days, and initial no‑fault claim filed within 30 days after accident

- Accident must be reported within 10 days to DMV if injury, death, or significant property damage occurred

Impact:

- Strict deadlines and offsets can reduce your actual payout unless you act promptly and track other benefits

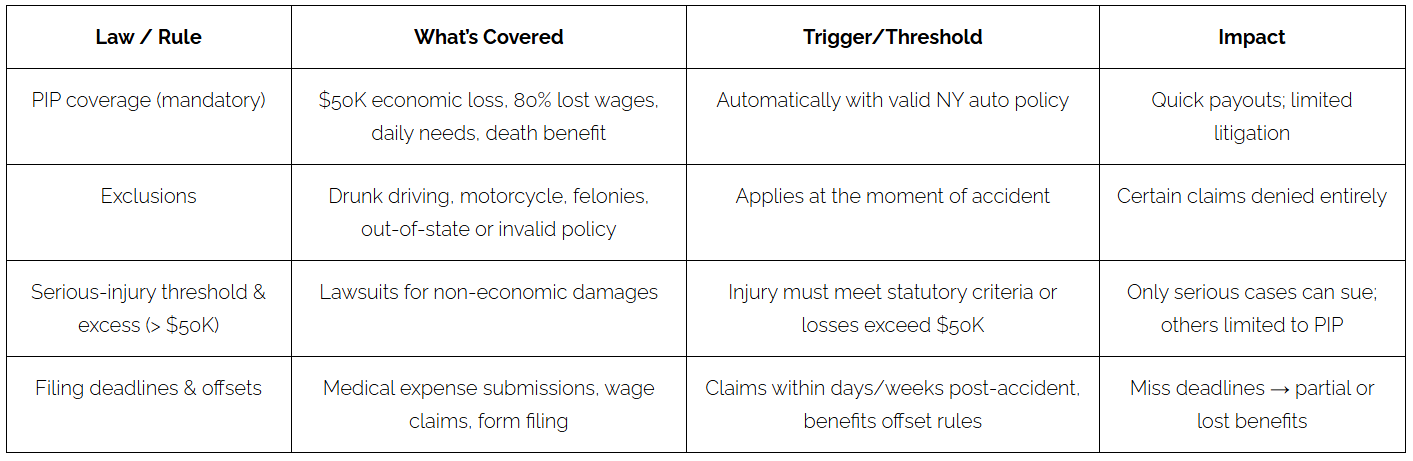

Summary Table: No-Fault Laws & Impacts

| Law / Rule | What’s Covered | Trigger/Threshold | Impact |

|---|---|---|---|

| PIP coverage (mandatory) | $50K economic loss, 80% lost wages, daily needs, death benefit | Automatically with valid NY auto policy | Quick payouts; limited litigation |

| Exclusions | Drunk driving, motorcycle, felonies, out-of-state or invalid policy | Applies at the moment of accident | Certain claims denied entirely |

| Serious-injury threshold & excess (> $50K) | Lawsuits for non-economic damages | Injury must meet statutory criteria or losses exceed $50K | Only serious cases can sue; others limited to PIP |

| Filing deadlines & offsets | Medical expense submissions, wage claims, form filing | Claims within days/weeks post-accident, benefits offset rules | Miss deadlines → partial or lost benefits |

Why This Matters to You

Under New York’s no-fault laws, your Personal Injury Protection (PIP) coverage is designed to cover specific “basic economic losses.” This coverage has a minimum limit of $50,000 per person and applies to a range of expenses, including:

Benefit of speed and certainty:

PIP grants near‑immediate access to economic recovery without fault-finding

Limitation on compensation:

No emotional, pain & suffering, or property damage under PIP

Legal threshold matters:

If you suffer a serious injury or incur over $50K in economic loss, you may pursue further compensation—but only if you meet New York’s strict criteria

Attention to detail:

Filing on time and tracking benefit offsets is essential